Perks that feel platinum forever

Get a platinum debit card with 811 Super. Enjoy a higher daily withdrawal limit of ₹1 lakh and a spend limit of ₹3 lakhs.

Feel like a superstar

Experience dedicated customer service. Use the 'Click to call' feature in our Kotak811 app for a prompt call back from our team.

Rewards that make spending worth it

Enjoy FLAT 5% cashback up to ₹6,000* per year (₹500 every month) on your Debit Card spends.

Safety that stays a cut above

Get unmatched insurance benefits

Personal accidental death cover up to ₹15 lakhs

Air accident insurance of ₹50 lakhs

Lost baggage insurance of ₹1 lakh

Purchase protection limit of ₹1 lakh

Lost card liability of ₹3.5 lakhs

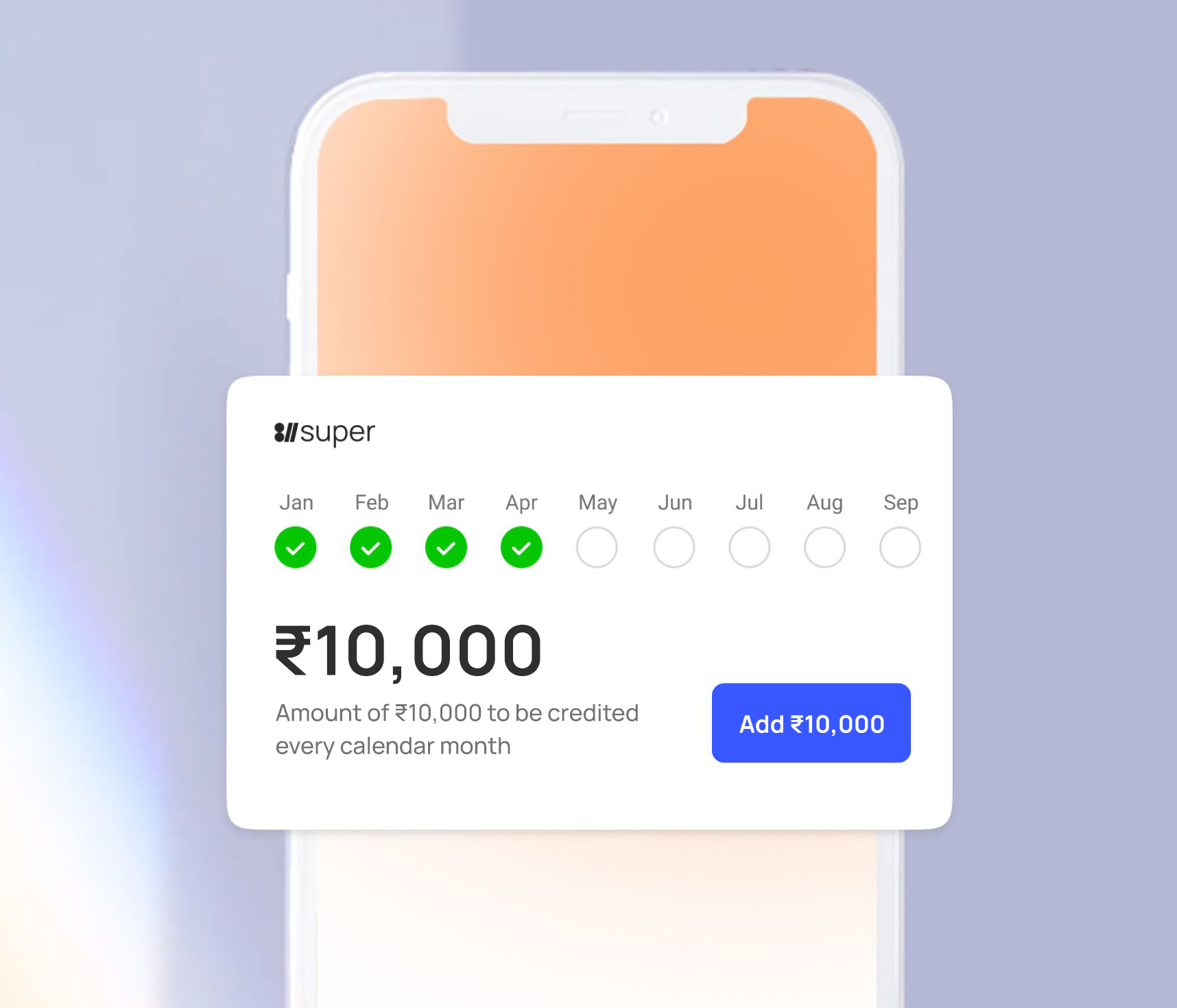

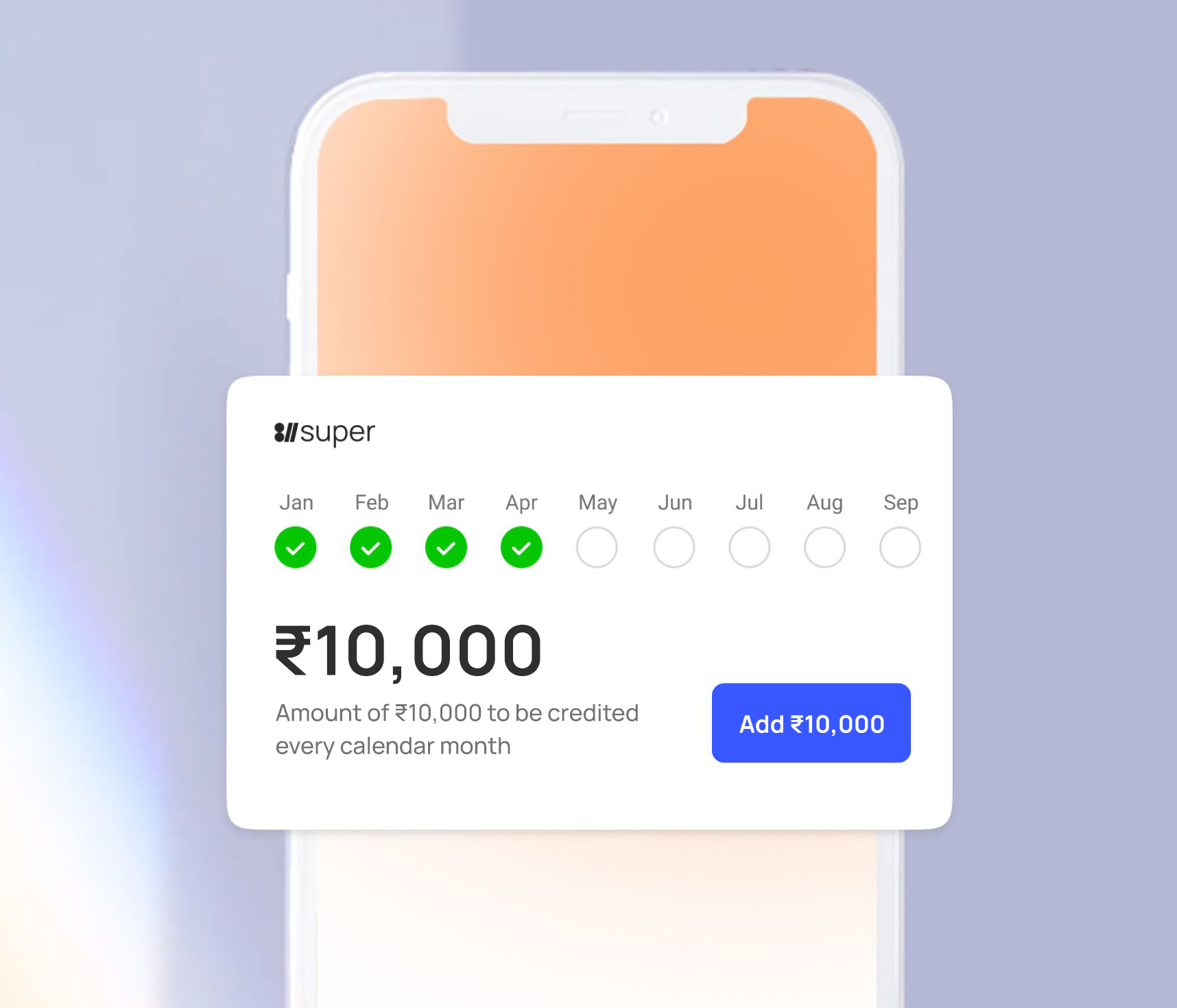

It’s super smooth

Deposit ₹10,000 in your account every month

Bag rewards for regular spending

Make life easier. Get your 811.

Open Kotak811 Super A/cAsk Kotak811

Frequently Asked Questions

How to check eligibility for 811 Super Savings A/c?

811 Super is an exclusive program available to limited customers currently. Download the new Kotak Bank 811 App to check your eligibility for 811 Super Savings A/c.

Will I have to maintain a minimum balance for this programme?

No. You don't have to maintain any balance to remain a part of this program.

What happens if I miss a deposit?

Missed a deposit? No sweat. 811 Super membership will be live for one year from date of subscription.

Do I have to deposit ₹10,000 in one transaction or can I split it into a few transactions?

It should be ₹10,000 in one transaction.

What is the cashback structure?

5% flat cashback up to ₹500/month will be given on Debit Card spends

Which type of transactions will be considered for cashback?

Debit Card spends via ECOM (E-commerce) & POS (Point of sales) will be considered.

Do I need to spend via Debit Card only?

Yes. Cashback only will be offered on Debit Card spend. Please check the detailed 811 Super Terms and Conditions

Will ATM transactions be considered for cashback?

No. Cashback will only be given on Debit Card spends via ECOM and POS.

How to enroll to this program if I already have an 811 account?

Just login to Kotak811 App and click on ''Upgrade to 811 Super''. You'll be added to the waitlist.

When and how will I get the cashback?

Your cashback will be credited to your account by 30th of the next month of the qualification month. It'll be credited in your account

How to reach the call center?

We've created a dedicated call center for you. Just place a request through Kotak811 app and our service officer will call you on your registered mobile number

What if I'm already holding a premium Debit Card?

No new card will be issued. All benefits will be transferred to the older Debit Card. Kindly refer the below link for card related Terms and Conditions

What if I'm already holding a cheque book?

No new cheque book will be issued.

What are the charges associated with 811 Super?

Kindly refer the below link for General schedule for charges.