What Is A Cancelled Cheque and How to Write It?

Cancelled Cheque Key Takeaways

|

For most people, cheque books are rarely used in daily transactions anymore. Yet, now and then, a form or financial document asks you to attach a cancelled cheque. It could be for opening a savings account, applying for an insurance policy, setting up SIPs, or even verifying your salary account. At that moment, many pause and wonder what exactly this means and how to write a cancelled cheque correctly.

If you have been in that situation, this guide explains everything — from what a cancelled cheque is to how to make one safely and the many times you might need one.

Also Read: What is a Cheque and Different Types of Cheque?

What a Cancelled Cheque

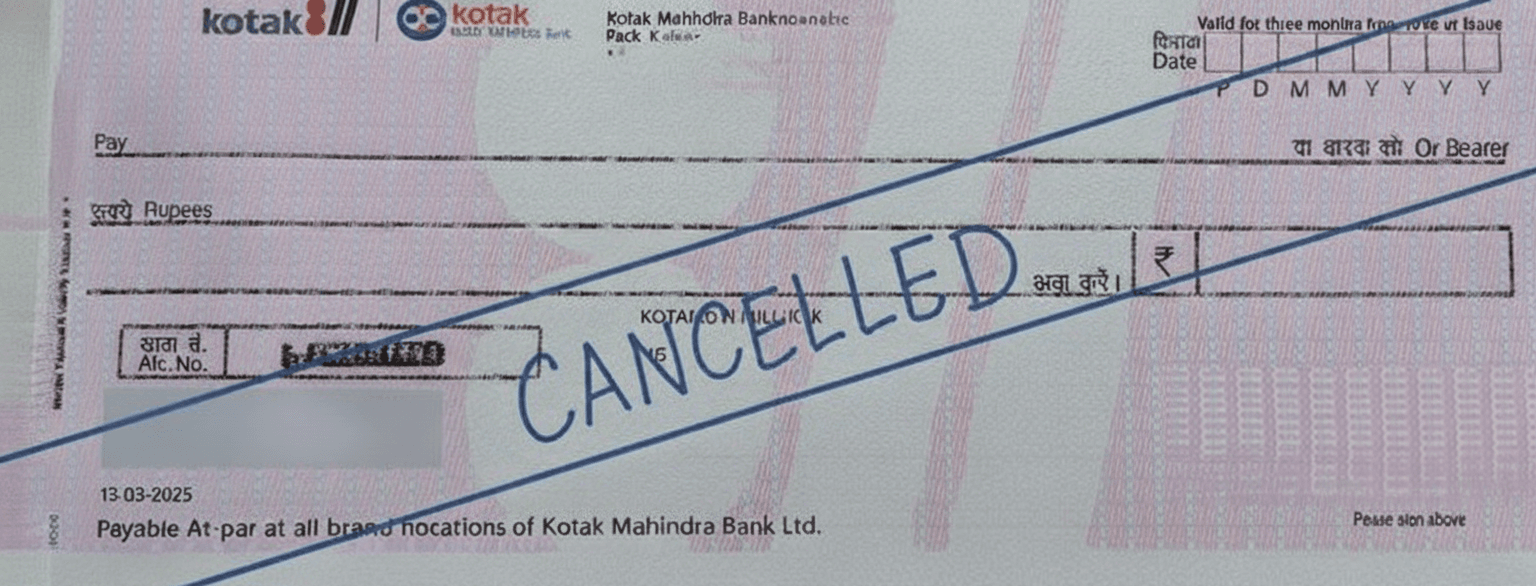

sample image

A cancelled cheque is simply a cheque from your cheque book that has two parallel lines drawn across it with the word “CANCELLED” written in between. It is not a cheque meant for payment. Instead, it is used to verify your bank details such as your name, account number, IFSC code, and bank branch.

The important thing to note is that even though you write the word "cancelled," the cheque is not voided in your account. It still represents your bank details, but cannot be used to withdraw or transfer money. That is precisely why it is often used as proof of account ownership in financial paperwork.

Why You May Be Asked for a Cancelled Cheque

There are several occasions where institutions require a cancel cheque as a standard verification document. Here are the most common situations:

- When opening a new bank account or a demat account

- While starting a Systematic Investment Plan (SIP) in mutual funds

- For applying for insurance policies

- During loan processing, such as home loans or personal loans

- For setting up the electronic clearing service (ECS) mandates

- When withdrawing or transferring your Employees’ Provident Fund (EPF)

In each of these cases, the cheque is not used for a transaction but only to confirm that the bank account details you provided belong to you.

How to Write a Cancelled Cheque Safely

Many people worry about making a mistake or invalidating the cheque incorrectly. The good news is, how to write a cancelled cheque is simple once you understand the right way.

Follow these steps to do it correctly:

- Take a fresh cheque leaf from your cheque book. Avoid using a filled or signed cheque.

- Draw two parallel diagonal lines across the cheque using a blue or black pen.

- Write the word “CANCELLED” in clear capital letters between the two lines.

- Do not sign the cheque anywhere. Your signature is not required on a cancelled cheque and leaving it unsigned keeps it safe from misuse.

- Ensure that all the important information is visible, such as your name, account number, MICR code, IFSC code and bank name.

That’s all it takes to make a cancelled cheque. The goal is to ensure your bank information is legible while keeping the cheque unusable for transactions.

Things to Keep in Mind Before Handing Over a Cancelled Cheque

Even though a cancelled cheque cannot be used to withdraw money, it still contains sensitive banking information. It is always a good idea to be cautious about where and to whom you provide it. Here are a few tips to remember:

- Give a cancelled cheque only to trusted institutions such as your employer, bank, or investment company.

- Avoid writing any additional information like date or payee name on it.

- Always double-check that you have not signed it.

- Retain a photocopy or image of the cheque for your records before submitting it.

This ensures your information stays secure while your verification process goes smoothly.

Difference Between a Cancelled Cheque and a Blank Cheque

People often confuse the two, but they serve very different purposes. A blank cheque is one where you have signed it but left the rest of the fields empty. A cancelled cheque, on the other hand, does not have any signature or transaction fields filled out. The cancelled one is used purely for information verification, while a blank cheque can authorise payment.

In other words, if you need to share your bank details for verification, provide a cancelled cheque, not a blank one. The former is safe, while the latter can be risky if misplaced.

Common Uses of a Cancelled Cheque

It helps to know where you might use this in future financial dealings. Some of the frequent uses include:

- Opening a new savings account: Banks may ask for a cancel cheque to confirm your existing account details when linking another account.

- Investment verification: Mutual fund houses often ask investors to provide a cancelled cheque to confirm the account where redemption or dividends will be credited.

- Loan applications: Lenders may request it to verify the account from which EMI payments will be done.

- EPF withdrawal or transfers: When claiming your Provident Fund (PF) the EPFO often requires a cancelled cheque to ensure the amount is sent to the correct bank account.

- Insurance or ECS setup: Insurance companies and service providers may request a cancel cheque while setting up automatic payment systems.

Each of these uses ensures accuracy and authenticity in financial operations, preventing errors in transferring or receiving funds.

How to Make a Cancelled Cheque Online

While the physical cheque remains the most accepted form, some banks now allow you to request digital cheque images through internet banking or mobile apps. However, not all organisations accept scanned or digital copies. If you need to submit it digitally, take a clear photograph of your cancelled cheque ensuring the word “CANCELLED” is visible and details are legible. Always check with the requesting institution before sending a scanned version.

If you are unsure about how to make a cancelled cheque digitally, you can visit your bank branch and request assistance. Most banks, including Kotak 811, can guide you through the process or provide an official document that serves the same verification purpose.

Managing Your Bank Details Efficiently

For modern banking customers, it is easier than ever to manage account details online. Digital-first banks such as Kotak 811 offer convenient access to account numbers, IFSC codes, and statements, often reducing the need for physical cheques altogether. Still, knowing how to make a cancelled cheque remains valuable, especially when dealing with legacy systems or formal paperwork.

Maintaining updated contact and account details ensures your transactions remain seamless, whether you are setting up auto-debits or applying for a new financial product.

FAQs

1. How to avoid misuse of a cancelled cheque?

Always write the word “Cancelled” clearly across the cheque to prevent anyone from filling it in for payment. Avoid signing it and share it only with trusted institutions for verified purposes like KYC or loan processing.

2. Is it safe to provide a cancelled cheque?

Yes, it is generally safe if the cheque is properly cancelled and not signed. It’s used only to verify your account details and cannot be used to withdraw money.

3. Can someone misuse a signed cheque?

Yes, a signed blank cheque can be easily misused as it authorises payment. Never leave the amount or payee sections blank on a signed cheque, and hand it only to trusted parties when necessary.

4. What can be given instead of a cancelled cheque?

You can provide alternatives like a bank account statement, passbook copy, or a voided online cheque image that shows your account number, IFSC code, and bank details. These documents serve the same purpose for verification.

Popular Searches on Kotak811

Kotak 811 | 811 Super Account | Super Savings Account Fees And Charges | Best Zero Balance Account Opening Online | Super.money Credit Card | Best Credit Card for Online Shopping In India | FD Credit Card | Visa Debit Card | Apply for Image Debit Card | Metal Debit Card | ActivMoney Savings Account | Open Savings Account Online | Savings Account Fees and Charges | Check Your CIBIL Score | Reactivate Dormant Account Online | Digital Savings Account | Apply for Personal Loan Online | Personal Loan for Education | Personal Loan For Marriage | Personal Loan For Medical Emergency | Personal Loan For Travel | Unsecured Personal Loans | Complete Guide on Fixed Deposit (FD) | Unfreeze Your Bank Account | How To Find Your Bank Account Number | How To Unfreeze Frozen Bank Account | How To Reactivate An Inactive Or Dormant Savings Account | What Is A Passbook | Zero Balance Current Account Opening Online | Zero Balance Current Account Fees & Charges | How To Get Airport Lounge Access On Debit Card | 811 Mobile Banking App

This Article is for information purposes only. The views expressed in this Article do not necessarily constitute the views of Kotak Mahindra Bank Ltd. (“Bank”) or its employees. Bank makes no warranty of any kind with respect to the completeness or accuracy of the material and articles contained in this Newsletter. The information contained in this Article is sourced from empanelled external experts for the benefit of the customers and it does not constitute legal advice from Kotak. Kotak, its directors, employees, and contributors shall not be responsible or liable for any damage or loss resulting from or arising due to reliance on or use of any information contained herein.

Share